Unlock the full potential of your insurance business by leveraging low-code platforms to streamline and enhance customer journeys.

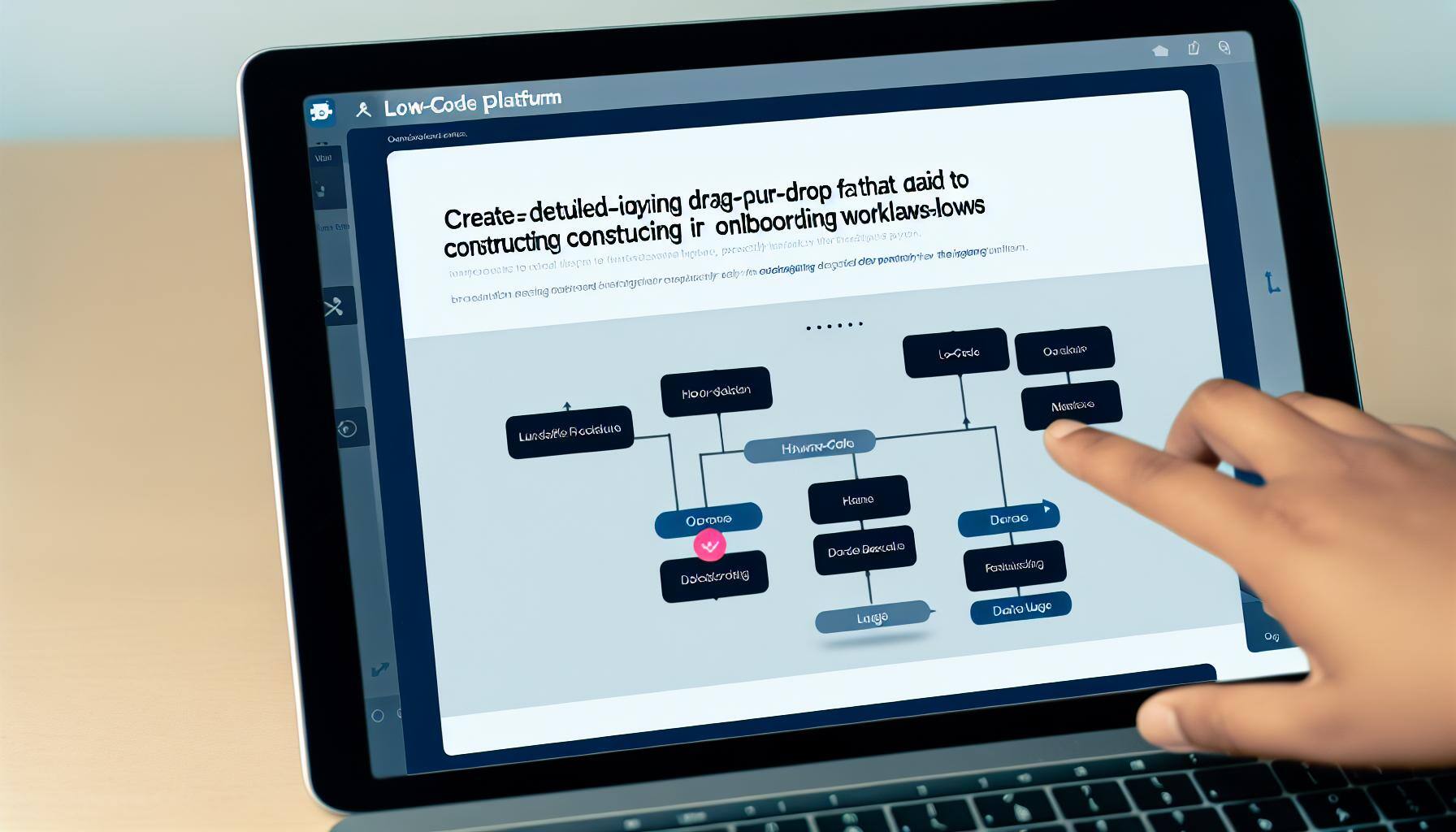

Streamlining Customer Onboarding with Low-Code Solutions

Low-code platforms like Swiftex offer a seamless way to streamline the customer onboarding process in the insurance sector. By automating data collection and verification, insurance companies can reduce the time required to onboard new customers. This not only speeds up the process but also minimizes errors and ensures a smoother experience for the customer.

With pre-built templates and drag-and-drop functionalities, agents can quickly design and implement onboarding workflows. This allows for a more personalized and efficient onboarding experience, making it easier to meet the unique needs of each customer.

Enhancing Claim Management Through Automation

Claim management is one of the most critical aspects of the insurance business, and low-code platforms can significantly enhance this process through automation. Automated workflows can handle claim submissions, approvals, and settlements more efficiently, reducing the time and effort required from both customers and employees.

By integrating low-code solutions, insurance companies can also improve the accuracy of claim processing, thereby reducing the risk of fraud and errors. This leads to quicker settlements and higher customer satisfaction.

Boosting Customer Engagement and Satisfaction

In today's competitive market, customer engagement and satisfaction are paramount. Low-code platforms enable insurance companies to develop customized and interactive customer portals that offer a range of services, from policy management to claim tracking.

These platforms can also facilitate real-time communication through chatbots and automated notifications, ensuring that customers are always informed and engaged. This level of personalization and responsiveness can significantly enhance customer loyalty and satisfaction.

Achieving Scalability and Flexibility in Insurance Operations

One of the standout benefits of low-code platforms is their ability to scale effortlessly. As your insurance business grows, these platforms can easily adapt to handle increased workloads without requiring extensive modifications to existing systems.

Low-code solutions like Swiftex provide the flexibility to integrate with various third-party applications and services, making it easier to expand your capabilities and offer new products and services. This ensures that your operations remain agile and capable of meeting evolving market demands.

Reducing Operational Costs and Increasing Efficiency

Low-code platforms can significantly reduce operational costs by automating routine tasks and eliminating the need for extensive manual labor. This not only cuts down on labor costs but also increases overall efficiency.

Furthermore, the ability to quickly develop and deploy applications without requiring specialized coding skills means that IT departments can focus on more strategic initiatives. This results in a more efficient allocation of resources and a faster return on investment for new projects.